Preparing for the coming “Cookiepocalypse”

B2B marketing professionals are bracing for the impending “cookiepocalypse” in the second half of 2024. This is when Google plans to phase out third-party cookies from its popular Chrome web browser. Competing browsers – including Apple’s Safari and Mozilla Firefox – have already been blocking third-party cookies for some time.

The trend away from third-party cookies has been building over the past few years. Factors behind the deprecation of third-party cookies include increasing consumer concerns over digital privacy and the corresponding expansion of data privacy regulations such as the California Consumer Privacy Act (CCPA) and the European Union’s ePrivacy Regulation (designed to streamline some of the EU’s current internet privacy regulations under GDPR.)

With the looming loss of the third-party cookie many marketers are worried about their ability to effectively target new accounts. However, third-party cookies are not as important as you think. In this guide we will show you how to utilise quantitative and qualitative analysis to target the best fitting and most profitable accounts for your organisation. When you have data-driven insights supporting your account segmentation strategy – cookies quickly lose their relevance.

80%

of users say the benefits of companies collecting data about them do not outweigh the risks.

Pew Research Center

44%

of internet users said brands using their data in advertising and marketing “often feels invasive.”

eMarketer

A word about cookies

To start, let’s define cookies and review how they work. Cookies are simply snippets of code that a website hosts. When you visit that site, the cookie is stored on your browser. As you browse from site to site, the cookie collects information about you and the topics you search for. This information is then used by marketers. There are two types of cookies:

- First-party cookies. These cookies are owned and placed by the publisher of a website. As visitors move through the site, first-party cookies collect data about them and their buyer journey for the sole use of that organisation.

- Third-party cookies. These cookies are placed on a host website by a separate (third-party) organisation – typically social media and advertising networks. If you visit a site that participates in one of these networks, the network places third-party cookies to collect data on your behaviour across multiple websites.

What third-party cookies do is enable organisations to compile behavioural profiles of individual buyers. While this is useful information for optimising online buying experiences, it is much less helpful for effective target account segmentation.

75%

share of marketers reliant on third-party cookies worldwide.

Statista

59%

share of businesses accelerating readiness for a cookie less future.

Statista

Principles of account segmentation

Instead of depending on third-party cookies, B2B marketers need to approach account segmentation by looking at the big picture. Account segmentation focuses on finding unique audience segments by examining common characteristics. By understanding similar account traits, needs and behaviours, marketing can better connect with potential buyers. The purpose of account segmentation is to select the most attractive segments that your company is best positioned to serve. Effective account segmentation reflects three principal factors:

- Market attractiveness. This is about identifying the accounts that are most likely to spend on your company’s offerings.

- Strategic fit. These are the accounts that align to your company’s business strategy and create sustainable revenue.

- Ability to win. These are the types of accounts that you are likely to win.

To intelligently build out account segments, B2B marketers can use two broad approaches:

- Qualitative. With this approach, marketers look at the key internal and external data that define the “best fitting” accounts to target.

- Quantitative. Marketers can analyse historic internal data for cohort similarities, lifetime customer value (LTV), and customer acquisition cost (CAC) insights to calculate the most profitable accounts to target.

85%

of global data and analytics decision makers use customer segmentations.

Forrester

Companies that exceed lead and revenue goals are 2.2X more likely to have and document personas and segments than companies that miss these targets.

Cintell

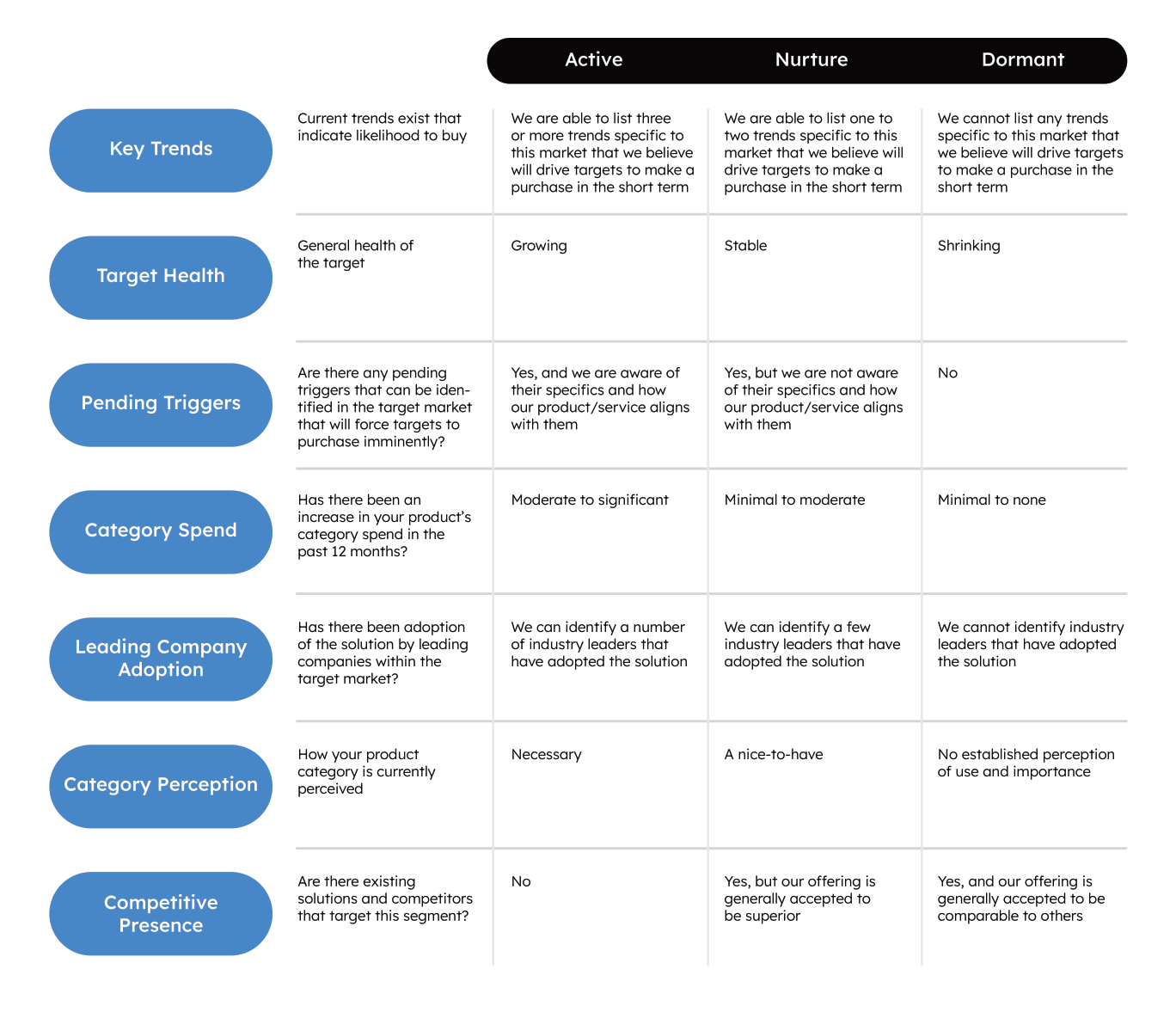

Qualitative analysis: External data

Instead of depending on third-party cookies, B2B marketers need to approach account segmentation by looking at the big picture. Account segmentation focuses on finding unique audience segments by examining common characteristics. By understanding similar account traits, needs and behaviours, marketing can better connect with potential buyers. The purpose of account segmentation is to select the most attractive segments that your company is best positioned to serve. Effective account segmentation reflects three principal factors:

- Market attractiveness. This is about identifying the accounts that are most likely to spend on your company’s offerings.

- Strategic fit. These are the accounts that align to your company’s business strategy and create sustainable revenue.

- Ability to win. These are the types of accounts that you are likely to win.

To intelligently build out account segments, B2B marketers can use two broad approaches:

- Qualitative. With this approach, marketers look at the key internal and external data that define the “best fitting” accounts to target.

- Quantitative. Marketers can analyse historic internal data for cohort similarities, lifetime customer value (LTV), and customer acquisition cost (CAC) insights to calculate the most profitable accounts to target.

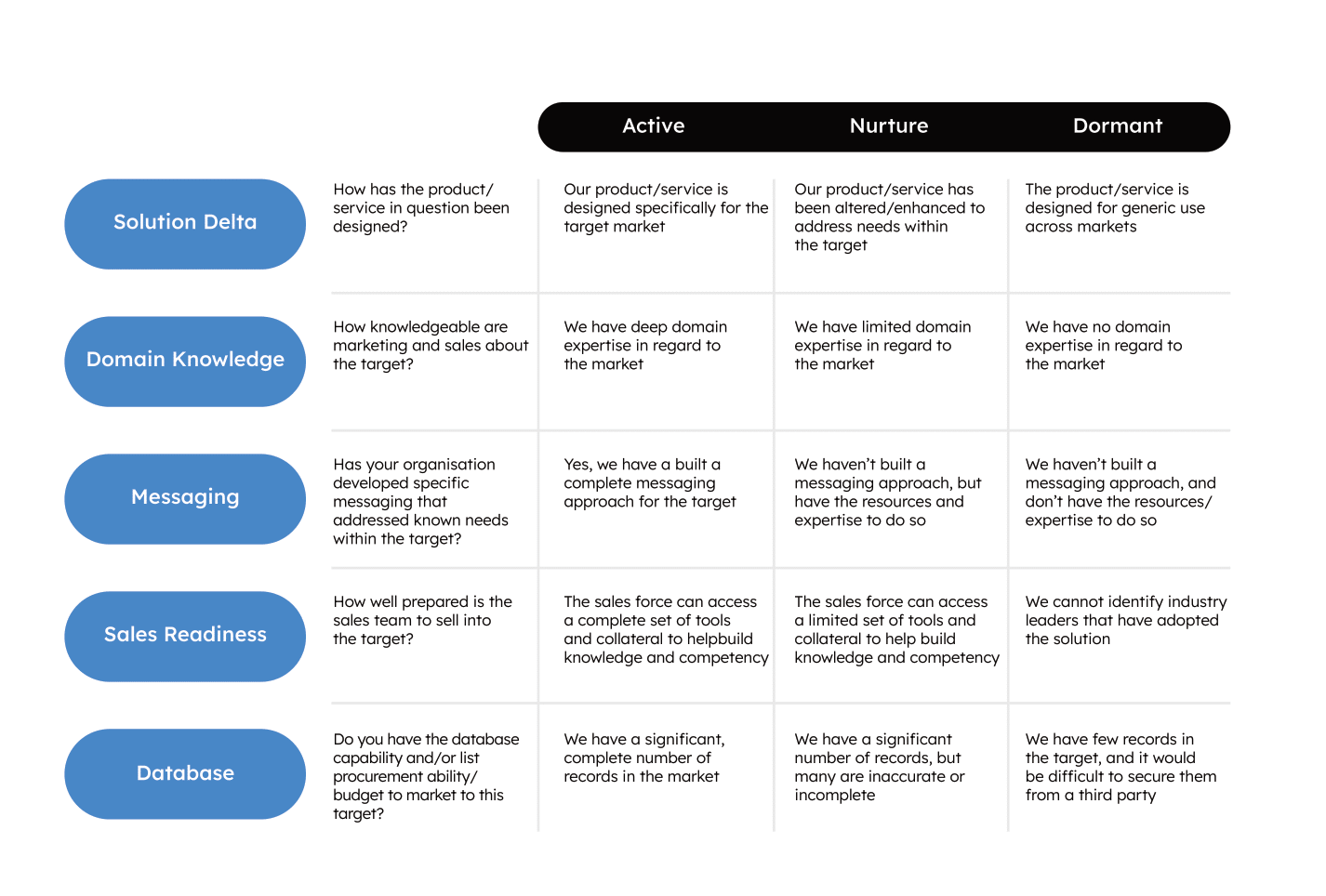

Qualitative analysis: Internal data

Company internal data is another great resource for account segmentation. You can work with your operations teams to pull data from CRMs and marketing automation platforms to gain insight into account segment differences.

The internal data to gather and assess as you develop account segments includes:

- Solution gaps. How many of the accounts’ problems does your solution solve? Is there a gap within current offerings to fully meet the account needs?

- Internal expertise. Does your company fully understand the needs of the target accounts? Do they understand the buyer personas, buying journey, and buying group requirements? Do they have subject matter expertise for target vertical markets or new geographies?

- Messaging. Is there specific messaging that is relevant for the different account segments? For the personas within the accounts?

- Sales readiness. Is your company’s sales force aligned and focused on the target accounts? Do they have the training, tools, collateral to engage with these accounts?

- Marketing database. Does marketing have access to relevant account segment data? Do you have data insights on these prospective accounts?

As you work through external and internal data for account segmentation, it’s crucial to have sales and marketing alignment on the account segmentation criteria. Leaders across both teams should negotiate the prioritisation of segment criteria that is relevant to your business before account segments are created.

Qualitative analysis: Cohort analysis

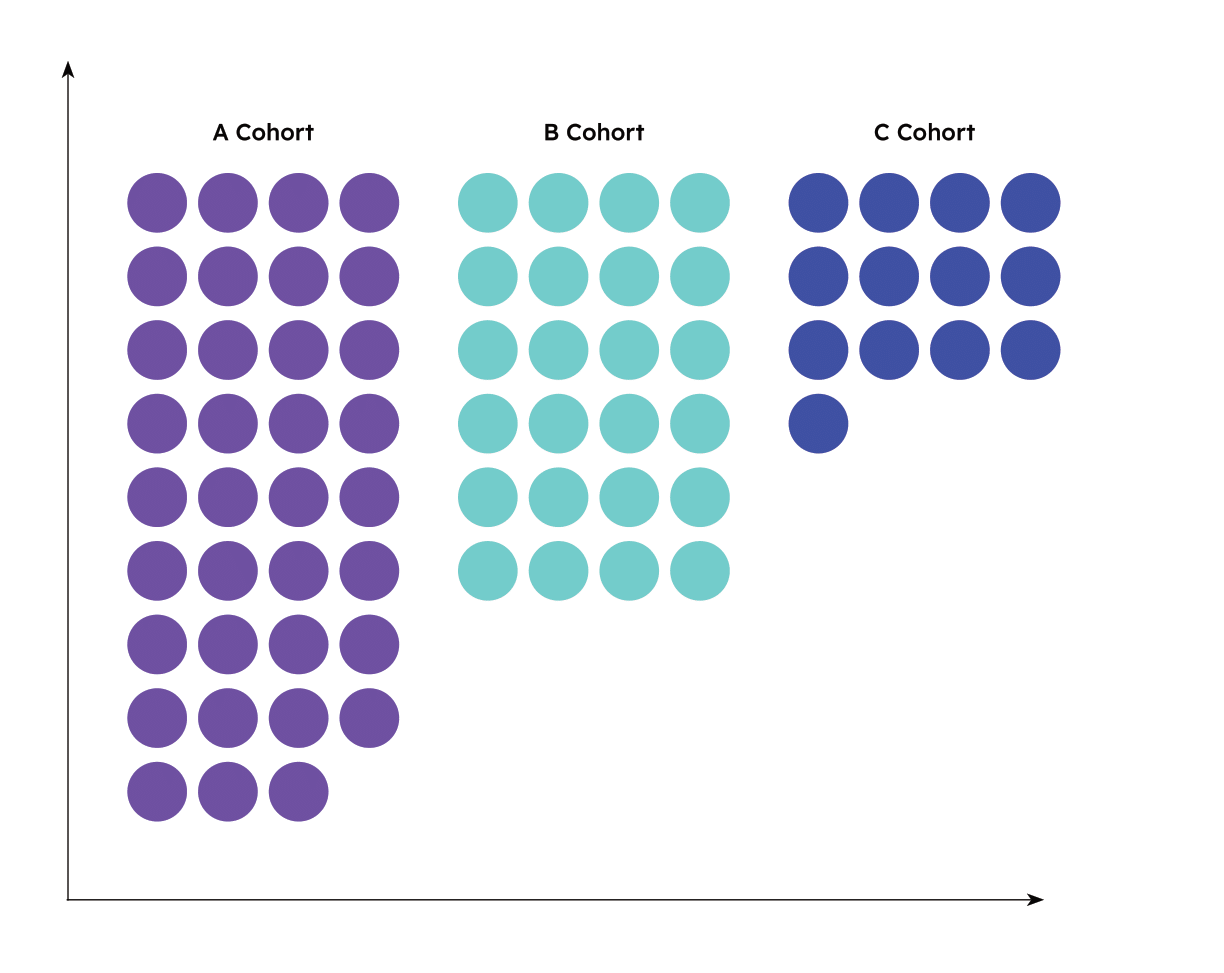

Cohort analysis is a type of behavioural analytics that helps you see what a sub-section of your existing customers (a “cohort”) is doing. Here’s how cohort analysis can be used for account segmentation:

- Define cohorts. Cohorts can be groups of accounts or customers that share certain characteristics. These can include industry, company size, geography, and other attributes.

- Data collection. Gather relevant account data. This can include transaction history, engagement metrics, and other data points relevant to your business.

- Segmentation criteria. Decide on the criteria you want for segmentation, such as purchase frequency, average contract value (ACV), or customer lifetime value (LTV).

- Create cohorts. Using the segmentation criteria, create account cohorts. For example, high (or low)-value accounts, industry-specific accounts, or accounts acquired through different channels.

- Analyse cohorts. Analyse the cohort behavior over time using metrics such as revenue, retention rate, churn rate, and customer satisfaction.

- Identify patterns. Look for trends within each cohort. Are there behavioural differences between cohorts? Can the patterns be extrapolated for new account acquisition?

By using cohort analysis for account segmentation, you can better understand your customers, improve retention, increase revenue, and make more informed decisions about resource allocation and marketing efforts. It provides a more targeted and data-driven approach to segmentation strategies.

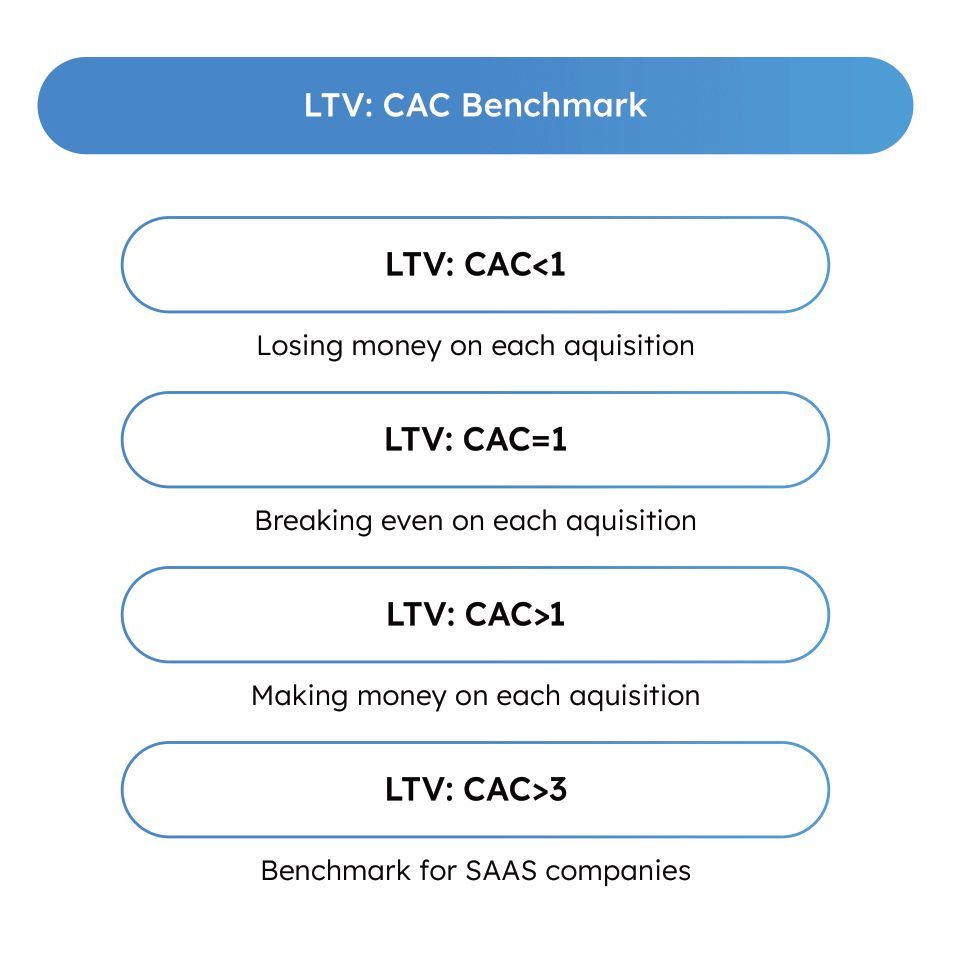

Qualitative analysis: LTV/CAC calculations

For businesses with recurring revenue, such as SaaS companies, the ratio of customer lifetime value (LTV) to customer acquisition cost (CAC) is a useful method to assess customer value. The LTV/CAC ratio will highlight your most profitable repeat customers, and help you target new accounts with similar attributes. We recommend partnering with finance to run this analysis for your company.

Here is how you can use LTV/CAC ratios for B2B account segmentation:

- Calculate LTV and CAC. Compute the customer lifetime value (LTV) and customer acquisition cost (CAC) for each account. LTV represents the total expected customer revenue, while CAC represents the cost of acquiring the customer.

- Segment by LTV/CAC ratio. Categorise accounts into three groups based on their LTV/CAC ratios:

a. High ratio. Valuable, highly profitable accounts.

b. Moderate ratio. Accounts with positive ROI, but lower profitability.

c. Low ratio. Less profitable or unprofitable accounts; be cautious with these. - Segment accounts. Use the ratios to guide your account segmentation and acquisition strategy. Focus on acquiring accounts likely to yield a higher LTV relative to their acquisition costs.

- Iterate and optimise. Review and adjust your account segments based on changing LTV/CAC ratios due to market shifts.

By using LTV/CAC ratios for account segmentation, you can make data-driven decisions that prioritise the most valuable accounts and increase profitability in your customer base.